If you’re selling on Shopify and dreaming of global expansion, there’s probably one massive profit leak you haven’t even noticed yet. Your payment gateway is quietly bleeding thousands of dollars from your business. Furthermore, it’s costing you sales you didn’t even know you were losing.

After building multiple seven-figure e-commerce businesses over the past decade, I’ve learned something critical. Choosing the right payment infrastructure isn’t just important, it’s absolutely essential to your success. Most international sellers lose a staggering amount of revenue to unnecessary fees, failed transactions, and abandoned carts. They’re simply using the wrong payment solution.

Throughout this guide, you’ll discover exactly why traditional payment gateways fall short for global sellers. More importantly, you’ll learn the specific strategies that successful international sellers use to maximize conversions and minimize costs. Additionally, I’ll show you how this connects to the broader framework we teach in the Passion Product Formula. By the end of this article, you’ll know exactly which payment gateway to use and how to set it up properly. This decision could be the difference between struggling to break even and scaling to multiple six or seven figures internationally.

- Why Shopify Payments Isn't Enough for Global Growth

- Converting Global Visitors into Paying Customers

- Eliminating Friction at the Final Hurdle

- Simplifying Your Financial Operations

- Connecting Your Financial Ecosystem

- What This Means for Your Profit Margins

- Getting Started with Airwallex

- Building Your Global E-commerce Empire

- Frequently Asked Questions

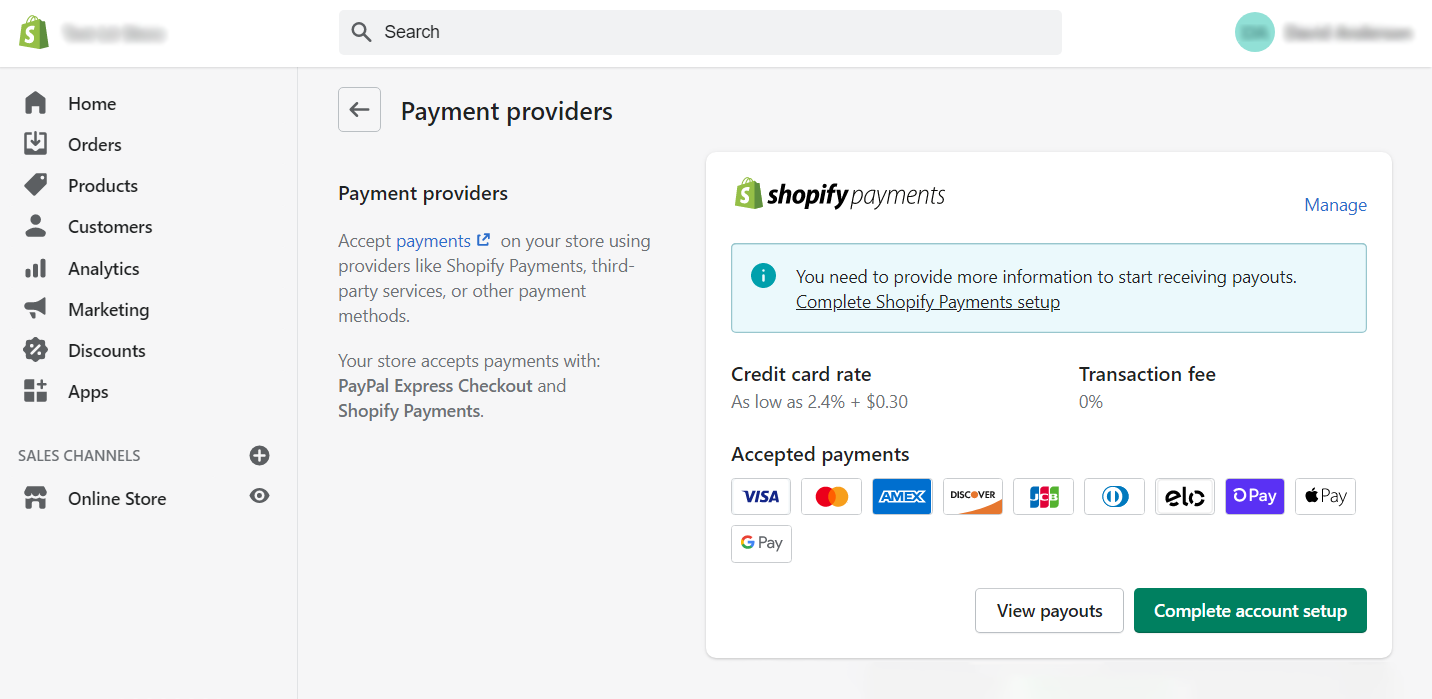

Why Shopify Payments Isn’t Enough for Global Growth

The Single Market Trap

Let’s start with the uncomfortable truth: Shopify Payments works great, until it doesn’t. For sellers operating exclusively in the United States or any single market, it’s actually the simplest option available. However, everything changes the moment you decide to expand internationally and start selling across borders.

International expansion introduces three critical pain points that basic payment gateways simply can’t handle effectively. First, you’re stuck with extremely limited payment options that alienate customers in different regions. Second, you’ll experience frustratingly low payment success rates as international transactions fail. Third, you’ll provide a poor localized checkout experience that screams “this store isn’t meant for me” to potential customers.

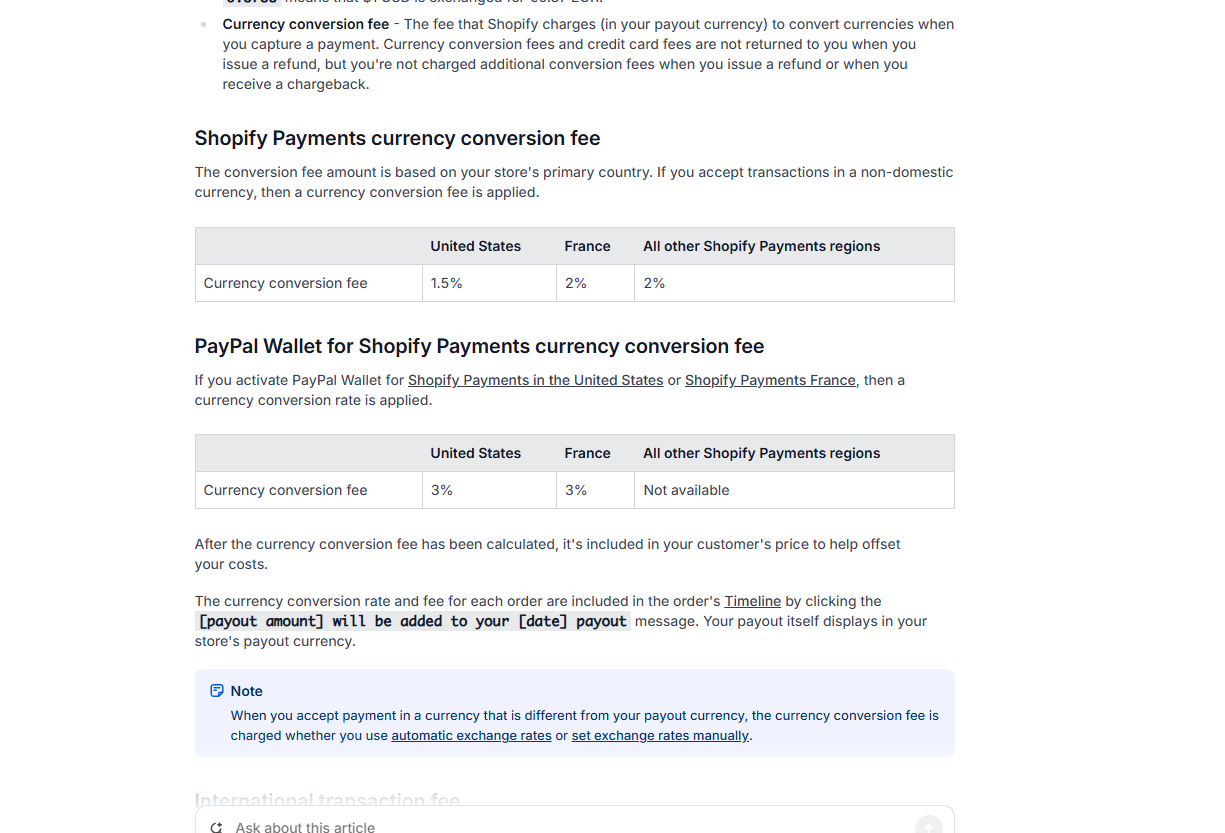

The Hidden Fee Problem

Beyond these conversion killers, there’s an even more insidious problem lurking beneath the surface: hidden costs. Most payment gateways hammer you with unnecessary currency conversion fees on every single transaction. On top of that, they charge excessive transaction fees that compound with each sale. Consequently, what looks like a profitable order often delivers far less profit than you expected.

This is precisely why understanding payment infrastructure becomes crucial when you’re building a sustainable international business. In the Passion Product Formula, we emphasize that choosing the right tools and systems from the beginning prevents costly mistakes down the road. While finding and validating the perfect product is essential, pairing that winning product with the wrong payment setup means leaving money on the table with every single sale.

Converting Global Visitors into Paying Customers

The Currency Confusion Problem

Imagine this scenario: A potential customer in Germany lands on your beautiful Shopify store after seeing your ad. They love your product and they’re ready to buy. Then they see the price displayed only in US dollars. Suddenly, they have to pause and mentally calculate what that actually costs in euros.

Every single second that your potential customer hesitates represents a massive opportunity for them to abandon their cart. Studies show that each additional moment of friction during checkout exponentially increases abandonment rates. This currency confusion creates exactly the kind of friction that kills conversions. Fortunately, you can completely prevent it with the right payment solution.

How Like-for-Like Settlement Works

This is where Airwallex‘s like-for-like settlement feature becomes absolutely game-changing for international sellers. Here’s how it works in practice: Let’s say you’re based in the United States, but someone in London discovers your store. That UK customer can pay for their order in British pounds. They see prices in the currency they understand and trust.

Meanwhile, you as the seller can settle that payment in pounds as well. You hold those funds in your account without any forced conversion back to dollars. Therefore, you completely avoid currency conversion fees while giving your customer a seamless local experience.

Dynamic Currency Display

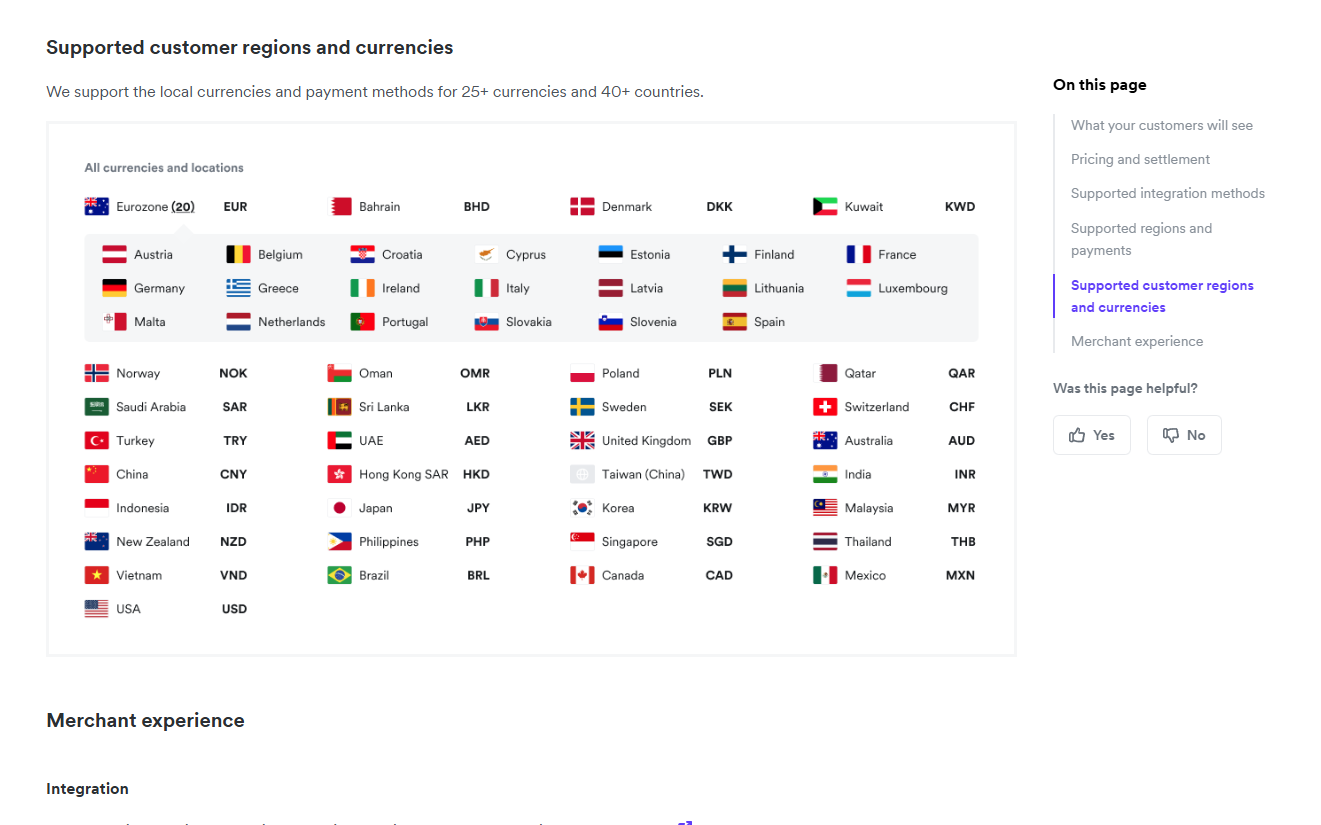

Airwallex currently supports over 14 major currencies, which covers the vast majority of profitable international markets. However, it’s not just about accepting these currencies on the backend, it’s about displaying them prominently throughout the shopping experience. The platform uses built-in dynamic currency switching that automatically shows pricing in your customer’s local currency based on their location.

A shopper in Europe sees euros. A customer in Mexico sees pesos. A customer in Japan sees yen. Crucially, this all happens right on your Shopify storefront. You don’t bounce visitors to some suspicious-looking third-party payment page that destroys trust and tanks conversion rates.

Eliminating Friction at the Final Hurdle

The Real Reason for Cart Abandonment

Here’s something that surprises most sellers when they start analyzing their checkout data: price isn’t actually the main reason people abandon their carts. Instead, the real conversion killers are friction and lack of trust during those crucial final moments before clicking “complete purchase.” This insight completely changes how you should think about optimizing your international checkout experience.

Your checkout page represents the make-or-break moment in your entire sales funnel. Consequently, every element on that page needs to work toward one goal: making your customer feel completely confident and comfortable completing their transaction.

The 160+ Payment Method Advantage

This is precisely where Airwallex provides an enormous competitive advantage. The platform supports over 160 different global and local payment methods. We’re not just talking about Visa and Mastercard here. This includes digital wallets, express one-tap checkout solutions like Apple Pay and Google Pay, and buy-now-pay-later options such as Klarna and Afterpay.

The mobile payment capability deserves special attention because it directly impacts your bottom line. According to recent data, a whopping 69% of all Shopify sales happened on mobile devices in 2024. Therefore, if your checkout doesn’t offer seamless mobile payment options, you’re actively losing sales to competitors who do.

Local Payment Methods Build Trust

Additionally, Airwallex excels at supporting region-specific local payment methods that customers in different countries prefer and trust. For example, you can accept iDEAL in the Netherlands, Afterpay in Australia, or Klarna in the UK. Interestingly, even if you’re using Shopify Markets with localized pricing, you can still run Airwallex‘s local payment method apps alongside your existing setup.

The psychology here is simple but powerful: when people see payment options they recognize and use regularly, they feel safe. This familiarity translates directly into higher conversion rates and dramatically lower cart abandonment. It helps you stand out from competitors still using generic, one-size-fits-all checkout solutions.

Simplifying Your Financial Operations

The All-in-One Platform Advantage

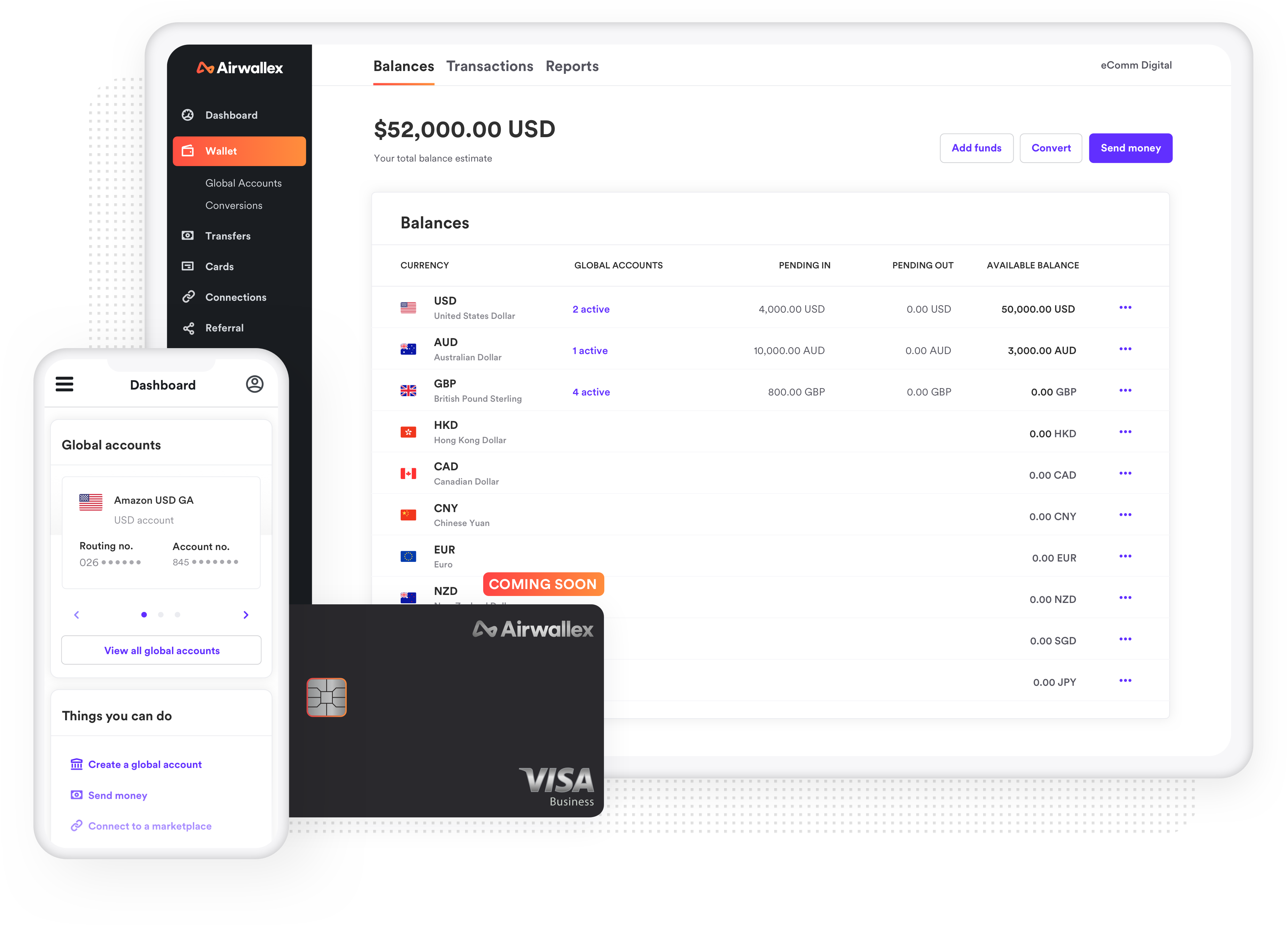

Beyond just accepting payments efficiently, Airwallex fundamentally transforms how you manage money across your entire e-commerce operation. Rather than juggling multiple disconnected tools and platforms, you get a truly end-to-end system. This system lets you receive, hold, and transfer funds all in one place.

This consolidated approach includes payment processing through the Shopify plugin. It also includes a multicurrency global account that allows you to hold more than 20 different currencies simultaneously. Additionally, you get spend management tools, corporate cards, and international transfer capabilities.

Faster, Cheaper Supplier Payments

Here’s where the operational efficiency really shines: You can settle your payments directly into an Airwallex multicurrency wallet. Then you securely hold those funds right there until you need them. This becomes incredibly valuable when it’s time to pay suppliers. You can transfer to manufacturers and vendors in over 200 countries directly from your wallet.

Even better, if you use Airwallex‘s local payment networks, transfers to suppliers in over 120 countries are completely free. On top of that, an impressive 95% of those funds arrive within the same day. Many transfers complete in just a few hours or even instantly.

Why the Cost Savings Are So Dramatic

The reason Airwallex delivers such dramatic cost savings compared to traditional payment solutions comes down to two key advantages. First, you can pay suppliers in their local currency. They prefer this, and it eliminates conversion fees on their end. Second, you can execute batch transfers in multiple currencies at once. This improves your operational efficiency while avoiding those costly conversion fees that slowly eat away at your profit margins.

Multicurrency Corporate Cards

Another often-overlooked feature is the ability to instantly issue multicurrency corporate cards for all your business purchases and expenses. Because these cards support multiple currencies natively, you’ll save a substantial amount on international transaction fees. This applies whenever you’re paying for advertising, software subscriptions, or any other business expenses denominated in foreign currencies.

Furthermore, these cards provide a real-time view of all your company spending in one dashboard. You can manage employee reimbursements all in the same place. This dramatically simplifies your accounting and bookkeeping processes.

Connecting Your Financial Ecosystem

The Disconnected Tools Problem

One of the biggest headaches for growing e-commerce businesses is dealing with disconnected financial tools that don’t talk to each other. When you build an online business the traditional way, you inevitably end up using a bunch of different platforms. This fragmentation adds massive complexity to your operations and often delays your access to funds.

Airwallex eliminates this problem through seamless integration with all the popular accounting and invoicing software platforms. Whether you’re running Xero, NetSuite, or QuickBooks, Airwallex hooks right in and automatically syncs your transaction data. This integration saves countless hours that you’d otherwise spend manually reconciling payments.

Standardized Reporting Across All Payment Methods

Here’s a feature that most people don’t initially appreciate but quickly becomes invaluable: Airwallex offers standardized settlement reporting across all payment methods. Essentially, this means that Airwallex consolidates and standardizes all your transaction and settlement data. This happens regardless of what payment method your customer used to complete their purchase.

Whether someone paid with a credit card, Apple Pay, Klarna, or a local payment method like iDEAL, everything appears in the same format. You see it all in your reporting dashboard. This consistency makes financial analysis and decision-making dramatically easier.

The Hidden Cash Bleed

Having worked with hundreds of international sellers, I know firsthand how difficult and time-consuming it can be to manage international payments. Tracking foreign exchange fees and reconciling everything at the end of each month takes tremendous effort. Most sellers are genuinely shocked when they finally sit down and calculate how much they’re bleeding in unnecessary fees.

In the Passion Product Formula, we emphasize that data-driven decision making is crucial for successful product launches. You can’t make good decisions if your financial data scatters across five different platforms. You need clear, consolidated data to analyze properly.

What This Means for Your Profit Margins

Real Numbers That Matter

Let’s talk about real numbers because that’s what actually matters at the end of the day. When you compare Airwallex to traditional payment processors, the cumulative savings add up incredibly fast. You’re saving on currency conversion fees every time you receive a payment in a foreign currency and saving on transaction fees with every sale. You’re saving on international transfer costs when paying suppliers and also saving significant time on reconciliation that you can redirect toward growing your business.

A Realistic Scenario

Consider this realistic scenario: Imagine you’re processing $50,000 per month in international sales across Europe, the UK, and Australia. With a traditional payment processor, you might pay 2-3% in currency conversion fees. Add standard transaction fees, plus additional fees when you need to pay your overseas suppliers. That could easily represent $2,000 to $3,000 per month in unnecessary costs.

Over a year, that’s $24,000 to $36,000 that could have been profit instead of payments to financial middlemen. Now multiply that by the lifespan of your business. Furthermore, consider how that saved money could be reinvested into inventory, advertising, or product development.

The Compounding Effect

The compounding effect of these savings becomes truly significant as you scale. This is exactly why successful international sellers obsess over their payment infrastructure. It’s not sexy or exciting, but it directly impacts whether your business is sustainably profitable or constantly struggling with tight margins.

Additionally, I’ve secured a special partnership with Airwallex that gives you access to even better pricing. There’s a link in the description that you can use to claim this exclusive discount. I’ve also included a detailed breakdown of the optimal setup depending on your specific Shopify plan.

Getting Started with Airwallex

Simple Implementation Process

Setting up Airwallex is remarkably straightforward, especially compared to the complexity of managing multiple disconnected payment tools. The implementation timeline is much shorter than most sellers expect. You can typically have everything up and running within a few days. Moreover, the platform provides clear documentation and support throughout the setup process.

Testing Before Full Launch

The key to successful implementation is testing thoroughly before directing all your traffic to the new payment setup. Start by enabling Airwallex alongside your existing payment methods. Then monitor the performance data carefully. You’ll want to track conversion rates, payment success rates, and customer feedback.

Most sellers are pleasantly surprised to see conversion rates increase almost immediately. This happens once customers start seeing familiar local payment options and transparent pricing in their own currency.

Optimizing for Your Shopify Plan

One best practice is to optimize your setup based on your specific Shopify plan. Different plan levels offer different capabilities and restrictions. For example, if you’re using Shopify Markets with localized pricing features, you’ll need to maintain Shopify Payments for card transactions. However, you can still layer Airwallex on top for local payment methods and improved fund management.

Support from Passion Product Formula

In the Passion Product Formula, we provide our students with implementation support for exactly these kinds of technical setup questions. While finding and validating winning products is crucial, we also recognize that proper systems and infrastructure make the difference. Our Accelerator Program includes done-for-you services that help you set up not just your product listings, but the entire operational infrastructure needed to succeed long-term in international markets.

Building Your Global E-commerce Empire

The Competitive Advantage of Proper Infrastructure

The payment gateway you choose represents far more than a simple technical decision. It fundamentally shapes your ability to compete and win in international markets. As we’ve explored throughout this guide, solving the two main challenges of localized checkout experiences and maximized payment success rates creates a genuine competitive advantage. Most of your competitors simply don’t have this advantage.

While they’re losing customers to currency confusion and limited payment options, you’ll be converting at higher rates. You’ll also be keeping more of your revenue. The beautiful thing about implementing proper payment infrastructure is that it’s a one-time fix. It continues paying dividends with every single transaction forever.

Beyond Payment Processing

However, payment processing is just one piece of the larger puzzle. Building a truly successful global e-commerce business requires getting dozens of different elements right simultaneously. You need product research and validation and need supplier sourcing and quality control. You need listing optimization and launch strategy. This is precisely why we created the Passion Product Formula and our comprehensive Accelerator Program.

The Complete Passion Product Formula System

The Passion Product Formula provides a complete system for building profitable e-commerce businesses. We combine your personal passions and interests with rigorous market validation. Our Accelerator Program takes this even further by offering done-for-you services. These include product research, manufacturing sourcing support, listing optimization, and launch strategy guidance.

You also get access to proven systems like the payment processing setup we’ve discussed today. When you join our program, you’re not just getting information, you’re getting actual implementation support. Our team has launched hundreds of successful products and built multiple seven-figure businesses. Click the link below to learn more about how the Passion Product Formula can accelerate your e-commerce success.

Frequently Asked Questions

Is Airwallex really cheaper than Shopify Payments for international sales?

Yes, significantly cheaper in most cases. The primary savings come from avoiding forced currency conversions. You can settle payments in the currency you actually want to hold. Additionally, Airwallex offers free transfers to suppliers in over 120 countries through local payment networks. Traditional bank transfers or payment processors charge substantial fees.

When you add up currency conversion fees, transaction fees, and international transfer costs, the savings become obvious. Most international sellers save thousands of dollars per month by switching to Airwallex.

Can I use Airwallex alongside Shopify Payments?

Absolutely, and this is actually the recommended setup for many sellers using Shopify Markets with localized pricing. You can continue using Shopify Payments for standard card transactions. Meanwhile, you run Airwallex‘s local payment method apps alongside to capture additional payment volume.

This dual approach gives you the best of both worlds. You maintain compliance with Shopify’s requirements while accessing Airwallex‘s superior local payment options and fund management capabilities.

How long does it take to set up Airwallex on my Shopify store?

Most sellers complete the basic setup within a few days. The Shopify plugin integration itself is straightforward and can be done in less than an hour. However, you’ll want to allocate additional time for account verification and testing different payment methods.

We recommend running Airwallex in test mode alongside your existing payment processor initially. Then gradually transition once you’ve confirmed everything works perfectly for your specific setup.

Which currencies does Airwallex support?

Airwallex currently supports over 14 major currencies for payment acceptance and settlement. This covers the vast majority of profitable international markets. The platform also allows you to hold more than 20 different currencies in your multicurrency wallet.

This covers all major markets including USD, EUR, GBP, AUD, CAD, JPY, and many others. If you’re targeting a specific market, you can check Airwallex‘s website for the complete list of supported currencies.

Do I need to be incorporated in a specific country to use Airwallex?

Airwallex supports businesses incorporated in many different countries, though availability varies by region. The platform was specifically designed to help international sellers and businesses operating across borders. They’ve built infrastructure to support companies from numerous jurisdictions.

That said, you’ll need to check their specific requirements based on where your business is legally registered. Regulations differ significantly between countries.

Will using Airwallex affect my conversion rates?

In the vast majority of cases, conversion rates actually improve after implementing Airwallex. This happens for several reasons. Customers see prices in their local currency which eliminates confusion. They find payment methods they know and trust. They avoid unexpected bank conversion fees.

The seamless checkout experience without redirects to third-party pages also builds trust and reduces abandonment. Most sellers report conversion rate increases of 10-30% after properly implementing localized payment options.

How does Airwallex compare to other international payment solutions like Stripe?

While Stripe is an excellent payment processor for many use cases, Airwallex specifically excels for international sellers. The key difference is that Airwallex provides like-for-like settlement. This means you can receive payments in one currency and hold them in that currency without forced conversion. Stripe typically converts everything to your home currency automatically.

Additionally, Airwallex offers the integrated multicurrency wallet, corporate cards, and free international transfers. This makes it a more complete financial operations platform rather than just a payment processor.

What happens to my existing transactions if I switch to Airwallex?

Switching to Airwallex doesn’t affect any past transactions processed through your previous payment gateway. Those historical payments remain exactly as they were. When you implement Airwallex, you’re simply changing how future payments get processed.

Many sellers choose to run both systems in parallel during a transition period. They gradually shift more volume to Airwallex as they become comfortable with the platform. This allows for a smooth transition without any disruption to your business operations or customer experience.