Before we dive into the details, watch this brief video introduction explaining the key steps to setting up your Amazon FBA business properly and why it’s crucial for long-term success. Learn how Doula and the Passion Product Formula can make this journey smoother:

Are you dreaming of launching a successful product on Amazon? If so, you’re not alone. Every day, aspiring entrepreneurs turn their ideas into reality by leveraging Amazon’s expansive marketplace. However, before you dive into the exciting world of product launches and sales, there’s one critical foundation you need to lay: setting up your business the right way.

This blog post will walk you through five essential steps to legally establish your Amazon FBA (Fulfilled by Amazon) business. Following these steps will not only protect you from future legal headaches but also set you up for long-term growth and financial success. By understanding these key steps and leveraging the right resources—like Doola and the Passion Product Formula—you can confidently build a successful business. Let’s dive in!

- The Importance of Proper Legal Setup for Amazon Success

- Step 1: Choosing the Right Business Entity

- How Doola Makes Business Setup Easy

- Step 2: Getting Your EIN for Tax Purposes

- Step 3: Applying for a Seller’s Permit

- Step 4: Setting Up a Business Bank Account

- Step 5: Unlocking Benefits with a Business Credit Card

- Protecting Your Amazon Business with Trademarks

- The Role of Continuous Compliance and Legal Updates

- Avoiding Common Pitfalls: Learn from Real-Life Examples

- Conclusion: Secure Your Business, Fuel Your Passion

The Importance of Proper Legal Setup for Amazon Success

Building an Amazon business is thrilling, but it’s important not to get caught up in the excitement and overlook the legal essentials. A proper legal setup ensures that your business operates smoothly, stays compliant with state and federal laws, and avoids potential penalties from the IRS or Amazon itself.

Many new sellers make costly mistakes—whether by skipping crucial paperwork or misunderstanding tax obligations—which can jeopardize their entire business. For instance, forgetting to file for a seller’s permit could lead to fines, and mixing personal and business finances could strip away the protection an LLC offers. To avoid such issues, setting up your business properly from the beginning is key. With the right foundation, you can focus on growth and innovation without constantly worrying about legal risks.

Additionally, having your business legally structured enhances credibility. Customers and partners are more likely to trust a business that is registered and compliant, creating more opportunities for collaborations and financing.

Step 1: Choosing the Right Business Entity

The first step in legally establishing your Amazon business is choosing the appropriate business entity. There are three main options to consider: LLC (Limited Liability Company), DBA (Doing Business As), and S-Corp (Small Business Corporation). Selecting the right structure depends on your business goals, expected growth, and the level of liability protection you need.

LLC: Limited Liability Company

An LLC is often the top choice for Amazon sellers because it provides significant legal protection. If your business faces a lawsuit, an LLC helps separate your personal assets from the company’s liabilities. This means that your personal savings, home, or other assets are protected from business-related lawsuits.

An LLC is particularly beneficial for businesses selling physical products, especially consumables, as these products carry higher liability risks. The legal shield provided by an LLC ensures that you can scale your business without fearing personal financial ruin in case of a product-related issue.

DBA: Doing Business As

A DBA is the simplest and most affordable option, but it doesn’t offer any legal protection. Essentially, a DBA allows you to operate under a business name without forming a separate legal entity. While it’s ideal for small-scale entrepreneurs, it’s not recommended for businesses expecting significant growth or legal exposure.

S-Corp: Small Business Corporation

An S-Corp offers certain tax advantages by allowing profits to pass through to the owners without being subject to corporate tax rates. However, it comes with additional requirements and can be more complex to manage. For most new sellers, an LLC or an LLC with an S-Corp structure is preferable.

To illustrate, the founders of Carnivore Electrolytes chose to establish their business as an LLC due to the nature of their product. Since it’s a consumable product, they wanted the added legal protection an LLC provides in case of any liability issues. This decision allowed them to focus on product development while knowing their personal assets were safeguarded.

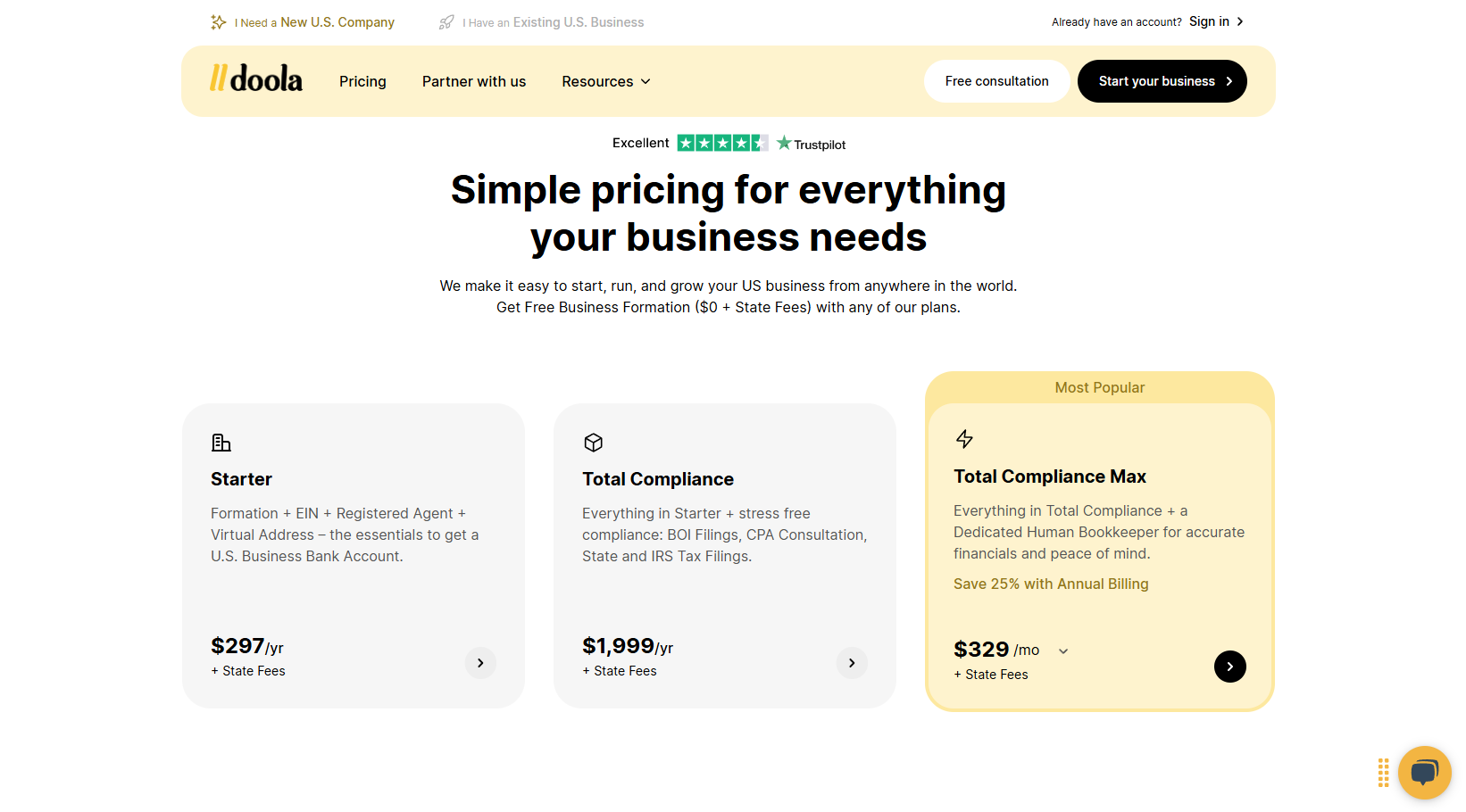

How Doola Makes Business Setup Easy

Setting up a business can be time-consuming and overwhelming, especially when you’re eager to start selling. That’s where Doola comes in. Doola’s business-in-a-box service is designed to handle the tedious paperwork and legal filings for you, so you can focus on what truly matters—growing your business.

With Doola, you don’t have to worry about navigating complex state laws, EIN registrations, or annual filings. Their streamlined process ensures that your business is legally compliant and set up quickly, saving you valuable time and effort. Additionally, Doola has helped over 10,000 companies establish themselves successfully, making them a trusted partner for new entrepreneurs.

Doola’s services go beyond mere business registration. They offer ongoing support for tax filings, compliance checks, and even consultations with experts, ensuring you’re never left in the dark when legal questions arise.

Step 2: Getting Your EIN for Tax Purposes

An Employer Identification Number (EIN) is like a Social Security number for your business. It’s required for filing taxes, opening a business bank account, and conducting various business activities. Without an EIN, you may face delays in important processes like applying for loans or setting up payroll.

Thankfully, obtaining an EIN is free and relatively straightforward. However, many third-party websites try to charge fees for this service. Avoid these scams by either applying directly through the IRS website or letting Doola handle it for you. With Doola’s assistance, you can rest assured that your EIN is obtained legally and efficiently.

When you obtain an EIN, it’s important to keep this number secure, as it’s tied to all your business operations. Doola’s service not only ensures accurate filing but also protects your information from misuse.

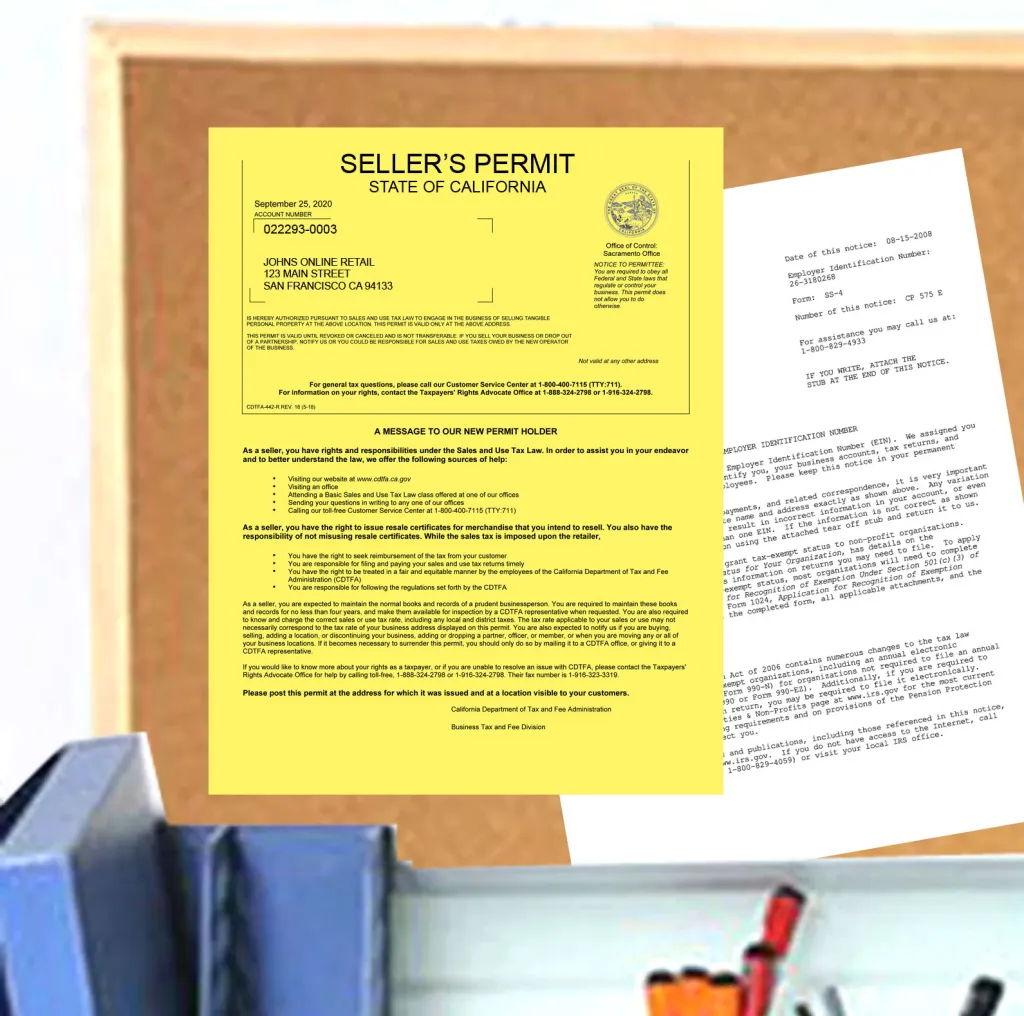

Step 3: Applying for a Seller’s Permit

A seller’s permit is crucial for collecting and remitting sales tax on items you sell through Amazon. Without it, you risk running into tax compliance issues that could lead to fines or penalties. The good news is that obtaining a seller’s permit is free and relatively easy.

To apply, simply search for your state’s online application process by typing “[Your State] Seller’s Permit” into Google. You’ll find official government websites where you can apply directly without paying any unnecessary fees. Once you have your permit, you’ll be able to buy inventory without paying sales tax upfront—a key advantage that can save you money.

For those who want a hassle-free experience, Doola can assist with obtaining your seller’s permit and ensuring your tax compliance.

Proper tax compliance doesn’t just help you avoid penalties; it also improves your business’s financial health. By ensuring accurate tax filings, you’ll have a clearer picture of your expenses and profits.

Doola’s Business-in-a-Box: Seamless Compliance Management

Managing compliance involves more than just filling out forms. You need to keep track of deadlines, renew licenses, and stay updated on changing regulations. Doola’s business-in-a-box service offers a comprehensive solution, handling everything from EIN registration to state tax filings and annual renewals.

By outsourcing these tasks to Doola, you can eliminate stress and reduce the risk of errors. Their dedicated account managers ensure that every step of the process is completed correctly, giving you peace of mind and the freedom to focus on growing your business.

With Doola’s help, you can also access additional resources like free consultations with certified accountants, ensuring you make informed financial decisions.

Step 4: Setting Up a Business Bank Account

Separating your personal and business finances is one of the most important steps in setting up your Amazon FBA business. A dedicated business bank account helps you track expenses, manage cash flow, and simplify tax filings. Additionally, it reinforces the legal protection provided by an LLC by keeping your finances distinct.

When choosing a bank, consider factors like fees, online banking options, and customer service. Many banks, like U.S. Bank, offer free business accounts specifically designed for small businesses. To open an account, you’ll need your business formation documents and EIN.

Doola can help you gather and organize the necessary paperwork, making the process smoother and faster.

Setting up a business bank account also improves your credibility with suppliers and lenders. Vendors are more likely to trust businesses with dedicated accounts, which could lead to better payment terms and financing opportunities.

Tips for Finding the Best Business Bank Account

Not all business bank accounts are created equal. To find the best fit for your needs, compare options based on transaction limits, monthly fees, and additional services like credit lines or merchant services. Here are a few tips:

- Look for banks that offer no monthly maintenance fees or waive fees with a minimum balance.

- Prioritize banks that have excellent online banking features.

- Ask about benefits like cashback or rewards programs for business spending.

By following these tips, you can find a bank that supports your growth while minimizing unnecessary expenses.

Additionally, consider whether the bank offers integration with accounting software to make bookkeeping easier. The right account can streamline your financial management and save you countless hours in the long run.

Step 5: Unlocking Benefits with a Business Credit Card

One of the most exciting aspects of starting a business is gaining access to business credit cards. These cards not only help you manage cash flow but also come with perks like travel rewards, cashback, and discounts.

For example, the Amex Gold Card is a popular choice among entrepreneurs because it offers 5x points on select business categories like advertising. These points can be redeemed for free flights, hotel stays, and more—allowing you to reinvest savings back into your business.

Business credit cards also help build your business’s credit history, which is essential when applying for larger loans or credit lines in the future. By using credit wisely, you can unlock significant benefits that contribute to your business’s growth.

Protecting Your Amazon Business with Trademarks

As your business grows, protecting your brand becomes essential. Trademarks safeguard your logo, brand name, or slogan from being used by competitors. There are two types of trademarks to consider:

- Wordmark: Protects a specific word or phrase, regardless of its design. Examples include brand names like “Coca-Cola.”

- Image Mark: Protects a specific design or logo.

Filing for a trademark is simple and can be done through the USPTO (United States Patent and Trademark Office) website. For most Amazon sellers, securing an image mark is sufficient to protect their branding.

Additionally, a trademark increases your brand’s value and can serve as a valuable asset if you ever decide to sell your business or license your products.

The Role of Continuous Compliance and Legal Updates

Setting up your business legally is just the beginning. To stay compliant, you need to monitor tax deadlines, file annual reports, and adapt to changes in regulations. Neglecting these responsibilities can lead to penalties or even suspension of your Amazon account.

Doola’s ongoing support services ensure that you remain compliant year-round. Their experts handle renewals, tax filings, and other requirements, freeing you to focus on growing your brand.

By staying on top of compliance, you also reduce the risk of audit triggers and costly fines. Proactive management of your legal obligations demonstrates professionalism and reliability, enhancing your reputation.

Avoiding Common Pitfalls: Learn from Real-Life Examples

Many Amazon sellers have faced setbacks due to minor errors in their legal setup. For instance, a simple typo on an EIN application or a missed filing deadline can result in delays or account suspensions.

However, by learning from the experiences of others and utilizing services like Doola, you can avoid these pitfalls and build a resilient business. One common issue is the failure to separate personal and business finances, which can lead to the loss of legal protections offered by an LLC. Doola’s experts help you avoid such mistakes, ensuring your business remains on solid legal ground.

Passion Product Formula: Your Gateway to Long-Term Success

The Passion Product Formula is more than just a course—it’s a proven strategy for turning your ideas into profitable products. With personalized mentorship, access to experienced coaches, and a small group setting, you’ll gain the tools and support needed to succeed.

By combining product development with proper legal setup, this program ensures that you’re fully prepared to thrive in the competitive world of Amazon FBA. Unlike generic courses, the Passion Product Formula focuses on actionable steps and hands-on guidance, giving you a competitive edge.

Additionally, participants benefit from exclusive insights into marketing, brand positioning, and scaling strategies—essential components of sustained success.

Conclusion: Secure Your Business, Fuel Your Passion

In summary, setting up your Amazon business legally involves five key steps: choosing the right business entity, obtaining an EIN, applying for a seller’s permit, opening a business bank account, and leveraging a business credit card. By following these steps and using resources like Doola and the Passion Product Formula, you can confidently launch and grow your business.

Don’t wait—take the first step today and turn your passion into a thriving Amazon business. With the right foundation, the possibilities are limitless.

FAQs

- What is the easiest way to legally set up an Amazon FBA business?

The easiest way is to use a service like Doola, which handles everything from business formation to compliance management. - How does an LLC protect my personal assets?

An LLC separates your personal assets from your business, providing protection in case of lawsuits or debts. - Can I handle my business setup without professional services like Doola?

Yes, but it requires extensive research, paperwork, and understanding of state and federal regulations. - When should I consider getting a trademark or patent for my product?

Trademarks are recommended once you establish a brand identity, while patents are only necessary for unique product designs. - What are the benefits of joining the Passion Product Formula program?

The program offers personalized guidance, access to expert coaches, and proven strategies to build and scale your Amazon business.